Fascinating Misfortune of Credit Suisse

Excerpt: This novel is a work of fiction and not based on a true story. However, parts of the narrative have been inspired by the history of and events that are publicly known to have taken place at Credit Suisse.

Introduction

As I’ve noted in the disclaimers, other parts of the website, as well as in the book itself, my novel is a work of fiction and not based on a true story. However, it would be misleading if I didn’t reveal truthfully that parts of the story have been inspired by the history of and events that are publicly known to have taken place at Credit Suisse. While SWB of the novel is not Credit Suisse per se and there is no direct resemblance of any of the characters in the book with people who may have been involved in the events surrounding the acquisition of the actual bank or otherwise, there is no denying that there are certain similarities between the fictional story of the book and the real history of the bank. I, therefore, thought that it may be of interest for some to read about the history of Credit Suisse and the events that took place in its final years in a compact form. What you will find below has been recited or summarized from factual information published by Credit Suisse itself, public (free) media sources, mainly Reuters, and publicly accessible court proceedings. Should parts of the information provided cease to be available on the Internet, they can be verified through Internet archives such as the Wayback Machine.

The Beginning of the Bank

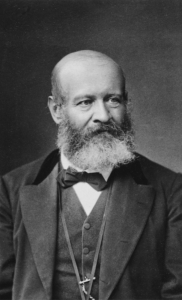

The history of Credit Suisse began on July 5, 1856, when Alfred Escher, a well-known businessman, legislator, and innovator, established “Schweizerische Kreditanstalt.” The new bank, known as SKA, was set up with the initial goal of funding Switzerland’s continued industrialization and growth of its railroad network. Alfred Escher headed the SKA as the first Chairman of the Board of Directors from 1856 until 1877 and again from 1880 until 1882. To this day he ranks among the most distinguished personalities of the 19th century and it may therefore be worthwhile to briefly look at the achievements of this key figure in the history of the bank.

Alfred Escher – Founder of Credit Suisse

This man appeared to have the magic touch: in addition to creating Credit Suisse, he was also involved in the founding of the Swiss Northeastern Railway, which was eventually incorporated into the Swiss national railway network, the Swiss Institute of Technology, ETH Zurich, pension provider Swiss Life, and the reinsurance company Swiss Re. As a politician, Escher held prominent positions as deputy chairman of the Swiss School Council, head of the government of Canton Zurich, and finally president of the Swiss National Council.

This man appeared to have the magic touch: in addition to creating Credit Suisse, he was also involved in the founding of the Swiss Northeastern Railway, which was eventually incorporated into the Swiss national railway network, the Swiss Institute of Technology, ETH Zurich, pension provider Swiss Life, and the reinsurance company Swiss Re. As a politician, Escher held prominent positions as deputy chairman of the Swiss School Council, head of the government of Canton Zurich, and finally president of the Swiss National Council.

Prioritizing the underdeveloped railway infrastructure, he started the Swiss Northeastern Railway for which he sought private funding. However, based on the experiences of other railway companies of the time where foreign investors were steering the management as they saw fit, he concluded that the capital should originate in Switzerland rather than outside the country. This he thought would be the only way to preserve Switzerland’s independence. Escher established the Schweizerische Kreditanstalt, which is the predecessor to Credit Suisse as mentioned, in effect to finance his railroad company.

It remains an enigma to this day how he managed to raise 221 million francs in just three days within Switzerland which at the time was behind all major powers in Europe as capital accumulation was concerned. He did this at a time when not even the telephone had been invented and the only means of communication was the telegraph which had been introduced in Switzerland just 5 years prior.

Escher was a visionary who also had a strong sense of realism. He understood the dangers associated with large-scale endeavors and was concerned about the safety of both people and projects. Thus, backed by funds from Credit Suisse, he established the first pension plan in Switzerland in 1857. He established the financial framework for a new reinsurance company’s hedging in 1863. Even now, Credit Suisse, Swiss Re, and Swiss Life serve as global representatives of Swiss financial and insurance know-how.

Escher fiercely advocated for the building of the Gotthard Railway, including the massive Gotthard Tunnel, which required a significant amount of funding. This was for him a key project since it would permanently end Switzerland’s economic isolation and provide a desirable transit route between southern and central Europe. He died the same year the project was completed.

The Early Expansion

The railway project was not the only industrial sector in which the Schweizerische Kreditanstalt invested soon after it was founded. It also financed Switzerland’s electrical grid through its partnership with Elektrobank. In similar ways, it helped a lot of new businesses and endeavors and was the catalyst for the nation’s transition from an agricultural one to one that is known across the world for its expertise in a variety of disciplines.

The bank’s first international representative office opened in New York, fourteen years after it was founded. After six further years, the headquarters of the bank was moved to its prestigious location at Paradeplatz in Zurich. However, losses in venture capital and agricultural businesses caused it to have its first year of loss-making in 1886. Early in the 20th century, Credit Suisse started offering savings accounts, currency exchanges, and deposit counters to customers and the middle class.

After acquiring Oberrheinische Bank, the bank opened its first branch outside of Zurich in Basel in 1905. It endured the Great Depression of the 1920s, aided businesses during World War I and assisted with post-war reconstruction. In 1939 it founded the Swiss American Corporation in New York and received the license as a fully accredited bank in New York in 1964.

The Post WW II Mergers and Acquisitions

The money laundering scandal in 1977 known as the Chiasso affair resulted in a historic loss and accelerated the bank’s transition to an international financial group. Only a year later, SKA and the US investment bank First Boston started cooperating to operate on the London bond market, which marked a significant shift in the bank’s strategy. The later years of the bank were marked by a number of high-value mergers and acquisitions:

- 1982: CS Holding was founded as a sister company of SKA to hold investments in industrial companies.

- 1988: As part of a rescue operation, CS Holding acquired a 45% stake in the US investment bank First Boston and renamed it CS First Boston. The investment involved $20 billion, the largest sum ever paid by a Swiss company.

- 1989: SKA was integrated into CS Holding as a subsidiary.

- 1990: The group took over the majority of CS First Boston and bought the Swiss private bank Bank Leu.

- 1993: The group took over Volksbank, the fourth largest bank in Switzerland, and a year later the Neue Aargauer Bank.

- 1997: As part of a restructuring, CS Holding was transformed into the Credit Suisse Group, and the name SKA was deleted; a strategic partner, the insurer Winterthur, was also taken on.

- 1999: The group bought the asset management business of Warburg, Pincus & Co., and a year later the Wall Street firm Donaldson, Lufkin & Jenrette.

- 2002: A reorganization created two entities: Credit Suisse Financial Services and Credit Suisse First Boston; two years later, with the addition of Winterthur, this became three units.

- 2005: Credit Suisse and CSFB merged: Credit Suisse First Boston brand name was no longer used.

- 2006: The group sold Winterthur to the French insurer AXA.

- 2008: In contrast to its competitor UBS, the bank survived the global financial crisis without government support.

- 2013: The group bought Morgan Stanley‘s wealth management business in Europe, the Middle East, and Africa.

The Downturn of Credit Suisse

The aggressive acquisitions within a timeframe of 30 years on one hand turned Credit Suisse into a global player, providing comprehensive solutions to clients in private banking, investment banking, and asset management but on the other forced an amalgamation of very different cultures, philosophies, and spheres of specialist knowledge weakening the traditional basis of the bank.

Gradually, American and British bankers consolidated their dominance in Zurich’s Paradeplatz, enforcing a wildly capitalistic corporate culture predicated on the expansion of commissions. Notoriety followed Morgen Stanley alum John Mack, who went on to become co-CEO. For a long while, the stern-looking German Oswald Grübel remained by his side. However, in 2007, Brady Dougan, an American, assumed leadership at the highest level.

At the same time, the attack on banking secrecy started weakening the customer base. Following the 2008 financial crisis, the US started to target Swiss financial organizations’ activities in an effort to raise tax income. Credit Suisse was one of the local institutions that had to pay billion-dollar fines.

2015 saw another change at the top as Brady Dougan was replaced by Tidjane Thiam. A shift in culture occurred along with the arrival of the insurance specialist. Instead of focusing on the riskier, New York, and London-influenced investment market, the company now positioned itself as a trustworthy asset manager for a growing number of wealthy, substantial Asian clients.

The End of Credit Suisse

But despite several corporate restructurings, Credit Suisse was plagued by one scandal after another, so cuts and spin-offs were inevitable. The Saudi National Bank was asked to acquire a stake of nearly 10% to provide liquidity, ending the proud history of Swiss majority ownership. But even that wasn’t enough to turn things around as the two investment funds Greensill and Archegos exploded in quick succession, leaving a gaping wound worth billions in the bank’s balance sheet. Not least as part of the Swiss Secrets publications, it also came to light how closely the bank continued to be involved in the global business of concealing assets.

Amid worries about the insolvency of the Silicon Valley Bank in California, shares of Credit Suisse fell more than 30% on 10 March 2023, hitting a record low of $1.5 (down from $100 in 2000). When the Saudi National Bank refused to inject further capital, five days later, the collapse accelerated. There was also no liquidity coming from Qatar Investment Authority or the Saudi conglomerate Olayan Group which were among the bank’s major investors. And when the bank’s unsecured bonds’ market price dropped to 33% of their par value, mainly due to unsubstantiated social media speculation, it declared that it would accept a 54 billion Swiss franc loan that the Swiss National Bank (SNB) was making available. However, the markets’ tranquility only lasted temporarily and investors and customers continued to withdraw money, reaching 10 billion Swiss francs in days.

The situation was so bad that the Swiss government and the SNB started negotiating to speed up UBS’s takeover of the bank. Despite its initial reluctance, UBS was compelled to announce on March 19, 2023, that an all-stock agreement had been reached to acquire Credit Suisse for a mere 3 billion Swiss francs. In order to protect it against future risks, Switzerland committed to providing UBS with loans and guarantees totaling about 260 billion francs of taxpayers’ money. The deal granted enormous clout to UBS, not only ridding it of its main rival at home but also making it a Swiss banking and wealth management giant with a $1.6 trillion balance sheet.

European regulators have questioned the moral hazard of AT1 bondholders losing capital rather than bank shareholders. Financial analysts assert that Switzerland’s economic sanctions against Russian individuals and businesses had a major impact on the bank’s demise. Credit Suisse controlled over $33 billion for Russian clients, which is 50% more than UBS did.

In late April 2023, a number of economists evaluated the political and economic implications, emphasizing the lack of banking competition in Switzerland’s economy as a consequence. The acquisition of UBS limited the choice of lenders, particularly for smaller and medium-sized enterprises. Credit Suisse’s global reach affected employment circumstances outside of the country as well. Reuters reported on the day of the merger that bankers in London were bracing for hundreds of potential job losses and a hit to Britain’s already-dented financial sector.

The Scandals

Financial analysts may blame top management changes or an uninspiring strategy for the demise of Credit Suisse. But more than anything else, the many scandals during its final years are to blame for the fate of the once invincible Swiss bank. Just eight of the more important of these scandals are listed below:

The Spying Scandal

Credit Suisse CEO Tidjane Thiam was forced to quit in March 2020 after an investigation found the bank had hired private detectives organized by the then COO and Thiam’s closest ally Pierre-Olivier Bouee to spy on the bank’s former head of wealth management Iqbal Khan after he left for archrival UBS. Credit Suisse downplayed the issue several times, calling it a singular occurrence. However, Switzerland’s financial regulator said the bank had misled it about the scale of the spying when in December it admitted a second executive, the bank’s former head of HR, had also been spied on. The regulator stated later that seven different spying operations had been carried out between 2016 and 2019. Apparently, Thiam had Khan followed due to a personal feud as they were next-door neighbors at the “gold coast” of Lake Zurich. Khan alleged that three men from the private security firm Investigo employed by Credit Suisse chased him and his wife through the streets of Zurich in a car, leading to a physical confrontation.

Effects of the Archegos Default on Credit Suisse

When American family office Archegos Capital Management went into debt in March 2021, Credit Suisse suffered a $5.5 billion loss. Due to the hedge fund’s heavily leveraged bets on specific technology stocks going bad, the value of its Credit Suisse portfolio fell. The bank was found to have behaved badly by an independent study into the incident, which blamed its losses on a basic breakdown in management and oversight at its investment bank, specifically in its prime brokerage section. Officials had missed very obvious signs of the financial meltdown of Archegos which was using huge sums of CS investors’ money.

Effects of the Greensill Funds’ Collapse on Credit Suisse

Credit Suisse was forced to freeze $10 billion of supply chain finance funds in March 2021 when British supply chain financier Greensill Capital collapsed after losing insurance cover for debt issued against its loans to companies. The Swiss bank assured investors in promotional materials that the high-yield notes posed no risk because the underlying credit exposure was adequately insured, thereby selling billions of dollars worth of Greensill’s debt to them. To manage its risk, Greensill had taken out credit insurance with a subsidiary of Insurance Australia Group and Tokio Marine had taken on the policies in 2019 when it bought the unit. But instead of communicating directly with Tokio Marine to confirm the insurer had no concerns about the validity of the policy, where an employee had exceeded his underwriting authority, Credit Suisse relied on emails with Marsh & McLennan, the broker that arranged them for Greensill. One expert said on the matter: “Clearly they didn’t do their due diligence, because if Credit Suisse was doing its job properly there is no way that they could not have identified these problems.” Most of the money was later returned to investors but the bank had to write off over $1.7 billion due to the scandal. In August 2021, the BBC reported that Mr. David Cameron, former prime minister of Britain had received around $10 million for two-and-a-half years part-time work as an adviser to Greensill.

The Resignation of Antonio Horta-Osorio

Credit Suisse chairman Antonio Horta-Osorio resigned in January 2022 after flouting COVID-19 quarantine rules. The sudden move came less than a year after he was brought in to clean up the bank’s corporate culture tainted by its involvement in various scandals. Board member Axel Lehmann took over as chairman.

The Suisse Secrets Scandal

In February 2022 dozens of media outlets published results of coordinated, Panama Papers-style investigations into a leak of data on over 18 thousand Credit Suisse customer accounts in previous decades worth more than $100 billion. The allegations in the media articles included that the bank had human rights abusers, drug traffickers, and corrupt businessmen under sanctions among its clients.

The Bermuda Trial

The Supreme Court of Bermuda ruled in March 2022 that former Georgian Prime Minister Bidzina Ivanishvili and his family were due damages of more than $600 million from Credit Suisse’s local life insurance arm due the damages as a result of a long-running fraud committed by a former Credit Suisse adviser, who was convicted by a Swiss court in 2018 of having forged the signatures of former clients, including Ivanishvili, over an eight-year period.

Drug Money Laundering at Credit Suisse

In June 2022, Credit Suisse and one former employee were found guilty by the Federal Criminal Court of Switzerland for allowing a Bulgarian cocaine trafficking gang to launder over 146 million Swiss francs, including 43 million francs in cash, some of it stuffed into suitcases, between 2004 and 2008. The court fined the bank 2 million Swiss francs, also confiscating assets worth more than 12 million francs that the drug gang held in accounts at Credit Suisse, and further ordered the bank to relinquish more than 19 million francs. The court discovered shortcomings in Credit Suisse’s oversight of the application of anti-money laundering regulations as well as its handling of client interactions with the criminal organization.

The Tuna Bond Fraud

In October 2021, Credit Suisse pleaded guilty to defrauding investors over an $850 million loan to Mozambique meant to pay for a tuna fishing fleet and agreed to pay U.S. and British regulators $475 million to settle the case. About $200 million of the loan went in kickbacks to three Credit Suisse bankers who pled guilty to criminal charges in the United States and Mozambican government officials. When the loan was modified in 2016, the bank concealed information from investors about a significant discrepancy between the amount raised and the purchase price of the boats. The International Monetary Fund (IMF) was not informed about a loan that Credit Suisse and the Russian bank VTB negotiated. The IMF withdrew its support from Mozambique after the country acknowledged receiving $1.4 billion in hidden loans, which caused the economy of the nation in southern Africa to collapse. The borrowing was guaranteed by the Republic pursuant to sovereign guarantees. These were governed by English law, with a jurisdiction clause in favor of the courts of England and Wales. In December 2022, a Mozambican court ruled that ten individuals, including state security personnel, and the son of the previous president were convicted of money laundering and bribery in connection with the tuna bonds controversy. Each received a prison sentence of more than ten years.

Category: Food for Thought

Tags: banking Credit Suisse Switzerland

Related Article: Recap of the Intriguing Banking History

Related Article: Fascinating Misfortune of Credit Suisse

Comments

Leave a comment